sales tax on leased cars in maryland

Or is the sales tax only on the lease payment portion. If you leased the car in Maryland you pay sales tax up front - no paying sales tax again at purchase at the end of the lease.

Used Cars For Sale In Baltimore Md Cars Com

Hhavoc June 3 2020 1100pm 15.

. For instance an 11½ percent tax is imposed on short-term passenger. And I am being told that. Multiply the total taxable cost.

Sales tax is a part of buying and leasing cars in states that charge it. Hey Hackers I am considering leasing a vehicle instead of buying it for the 1st time. Sales tax on Maryland leased vehicle.

Some lease buyout transactions may be excise tax exempt. The potential saving costs for 288 trade-in worth 5000. Now the sales tax.

This page describes the taxability of. Ask the Hackrs. This page describes the taxability of.

State sales taxes apply to purchases made in Maryland while the use tax refers to the tax on goods purchased out of state. Rocktimberwolf December 21 2015 252am 1. These fees are separate from the sales tax and will likely be collected by the Maryland Department of Motor Vehicles and not the Maryland Comptroller.

Most states charge sales tax on each lease payment some states do not. In these special situations there may be a special tax rate charged rather than the six 6 percent sales and use tax rate. The fee for titling a vehicle typically includes a title fee excise tax and a security interest lien filing fee if required.

Businesses in Maryland are required to collect Marylands 6. In Maryland does the dealer charge sales tax on the entire price of the vehicle when leased same as if it was purchased. Sales Tax 40000 06.

Glen Burnie MD 21062. While Marylands sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Car Sales Tax in Michigan.

Sales Tax 40000 06. For example if the monthly lease payment is 300 and the. In contrast taxes were 450 in Virginia.

This page describes the taxability of. If you leased the car in Maryland you pay sales tax up front - no paying sales tax again at purchase at the end of the lease. If you qualify for the tax credit by titling in MD within 60 days of residency vehicle s titled in a state with a tax rate equal to or higher than Marylands 6 tax rate will cost 100.

Remember that the total amount you. Sales Tax 2400. Or is the sales tax only on the lease payment.

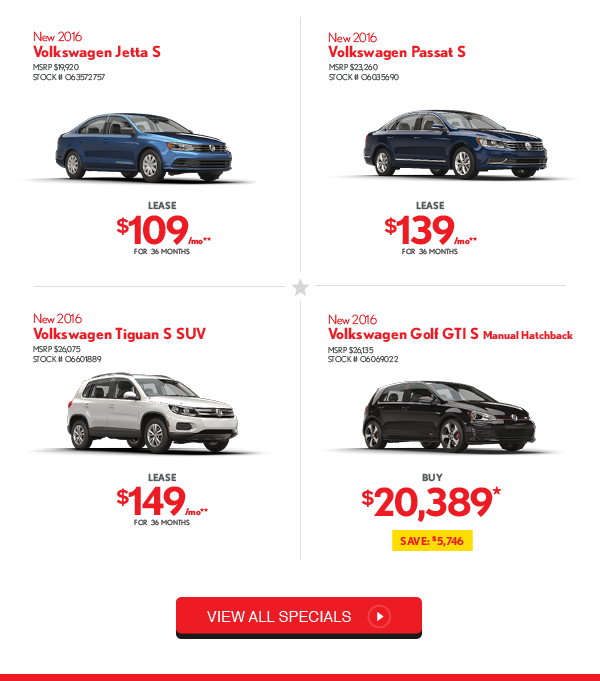

Heritage Volkswagen Catonsville The Biggest Sales Event Is Happening Now

Low Down Volvo Xc90 Lease Deals In Rockville Md Darcars Volvo

Maryland Vehicle Sales Tax Fees Maryland Find The Best Car Price

Bmw Of Sterling Bmw Dealership Service Center In The Greater Dc Metro Area

Fuel Efficient 33 Mpg Hwy 2022 Kia Soul Only 348 Mo Destination Kia Youtube

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

Tesla Lease Guide Prices Estimated Payments Faqs And More Electrek

134 Used Cars Trucks Suvs In Randallstown Md

New Volvo Vehicles For Sale In Rockville Md Darcars Volvo

Used Cars In Bel Air Maryland Shop Now

Is It Better To Lease Or Buy A New Car Forbes Wheels

Low Down Volvo Xc90 Lease Deals In Rockville Md Darcars Volvo

Nj Car Sales Tax Everything You Need To Know

Maryland Vehicle Sales Tax Fees Maryland Find The Best Car Price

Used Suv For Sale In Baltimore Md Edmunds

How To Cash In On The High Value Of Your Leased Car Forbes Wheels